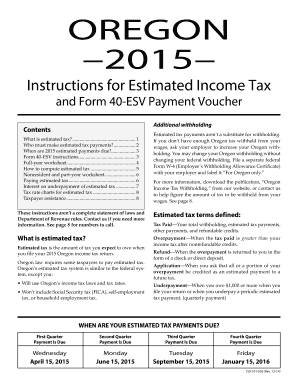

OR DoR 40-ESV 2015-2026 free printable template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out the Oregon Estimated Income Tax Payment Voucher (Form 40-ESV)

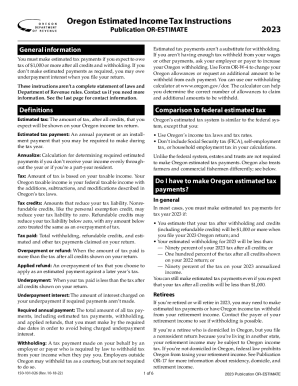

Understanding the Oregon Estimated Income Tax Payment Voucher (Form 40-ESV)

Form 40-ESV is an essential document used by residents of Oregon to report and make estimated income tax payments. This form allows taxpayers to pay taxes before filing their annual returns, thus avoiding potential penalties for underpayment. Understanding its purpose is critical for any taxpayer navigating the Oregon tax system.

-

It facilitates taxpayers in making periodic payments toward their state's income taxes, helping to spread their tax liability throughout the year.

-

For those whose income isn't subject to withholding, estimated payments are vital to avoid a large tax bill when filing.

-

Most Oregon taxpayers whose expected tax liability is $500 or more must file this form.

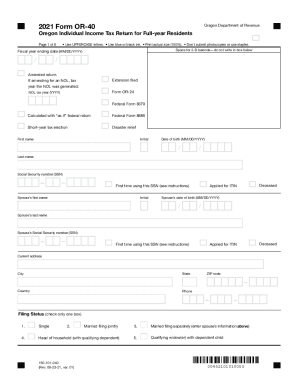

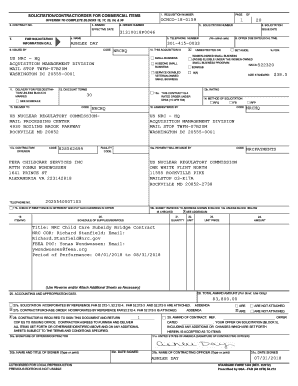

Filling out Form 40-ESV: Step-by-Step Instructions

Filling out Form 40-ESV requires careful attention to detail, as incorrect information could lead to delays or penalties. Following a structured approach can simplify the process and enhance accuracy.

-

Begin by entering required personal information including your Social Security Number (SSN), names, and addresses.

-

Indicate whether you're filing for the current tax year or a fiscal year ending.

-

Let the form know if you are a first-time filer or if you have changed your name.

-

Clearly enter the estimated payment amounts for each quarter based on your expected income.

Payment schedule for Form 40-ESV

Oregon's tax system requires making estimated payments on a quarterly basis. Being aware of deadlines is crucial to avoid any potential penalties.

-

The first payment is typically due on April 15, with subsequent payments due on June 15, September 15, and January 15.

-

Late payments can incur penalties, leading to increased tax liability.

-

Consider using tools available on platforms like pdfFiller for email reminders and tracking options for payments.

Where to mail your completed Form 40-ESV

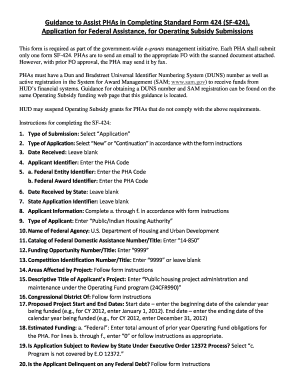

Sending your completed Form 40-ESV to the correct mailing address ensures it reaches the appropriate department for processing. This is a straightforward but critical step in the filing process.

-

The completed form should be sent to the Oregon Department of Revenue at the specified address outlined in the form's instructions.

-

Double-check the address and use a reliable mailing method to ensure your form reaches its destination.

-

Check with the post office or consider using a service that provides tracking for your submission status.

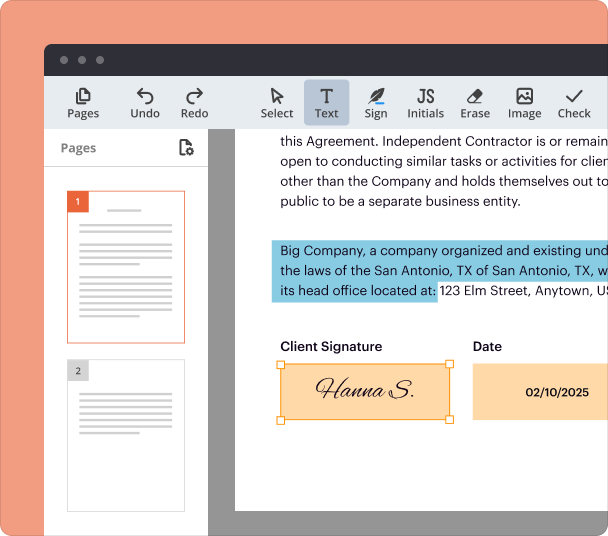

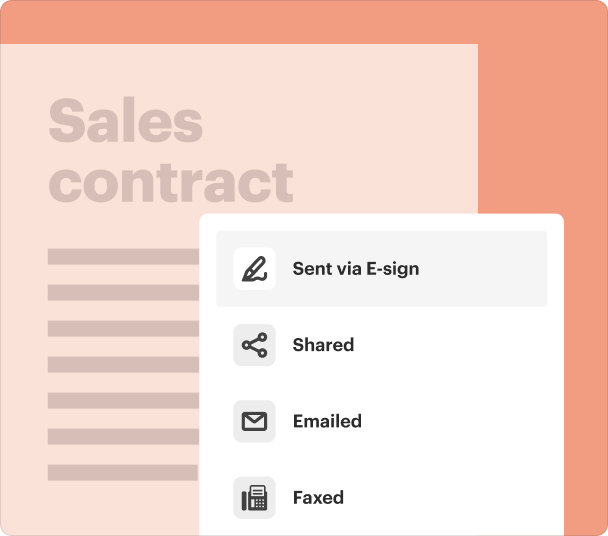

Editing and signing your Form 40-ESV with pdfFiller

Using a digital platform like pdfFiller can simplify the process of editing and signing your Form 40-ESV, allowing for a smoother submission experience.

-

pdfFiller allows you to edit and customize your form directly online, making it easy to adjust details as needed.

-

Add electronic signatures for faster processing and ensure your submission is legally binding.

-

Share documents and collaborate with others, enhancing team productivity when preparing tax documents.

Troubleshooting and common issues encountered

Technical challenges when filling out online forms are not uncommon, and knowing how to resolve them can save time and frustration.

-

Issues can arise from PDF visibility or form submission errors when using online platforms.

-

Switching browsers or checking for updates can often resolve display issues.

-

If problems persist, reach out to customer support for direct assistance.

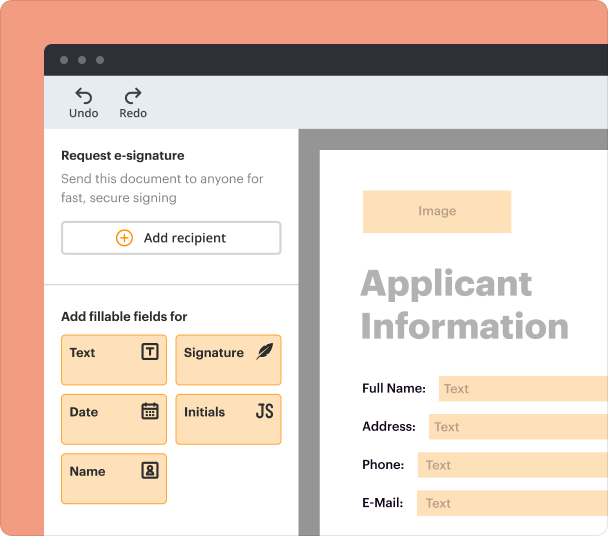

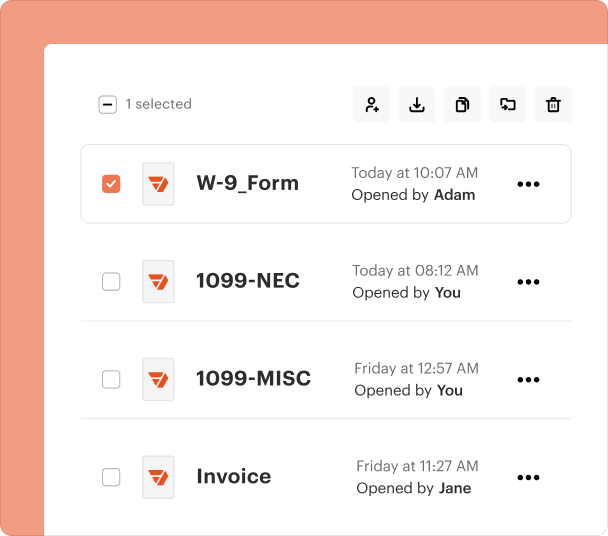

Utilizing pdfFiller's features to manage your tax documents

Managing tax documents effectively is crucial, and pdfFiller offers a myriad of features to help organize and streamline your filing processes.

-

With pdfFiller, you can store and organize all your tax documents in the cloud, making them accessible anywhere.

-

Integrates with various applications to facilitate comprehensive document management.

-

Having a single platform for document needs enhances efficiency and ensures nothing is overlooked.

Frequently Asked Questions about oregon estimated income form

What is Form 40-ESV?

Form 40-ESV is the Oregon Estimated Income Tax Payment Voucher, which helps taxpayers report and pay their estimated income taxes throughout the year.

Who needs to file Form 40-ESV?

Individuals and businesses expecting to owe $500 or more in state income taxes are generally required to file Form 40-ESV.

When are the payment deadlines for Form 40-ESV?

The estimated payments are due quarterly: April 15, June 15, September 15, and January 15.

Can I edit Form 40-ESV after I've downloaded it?

Yes, you can edit Form 40-ESV using platforms like pdfFiller, allowing for real-time adjustments and digital signatures.

What to do if I miss a payment deadline?

If you miss a payment deadline, it's important to pay as soon as possible to minimize penalties. Contact the Oregon Department of Revenue for guidance.

pdfFiller scores top ratings on review platforms